The Safe Harbor is very meaningful for direct Ponzi Scheme victims – like those involved with the FTX, SBF and Alameda Research fraud.

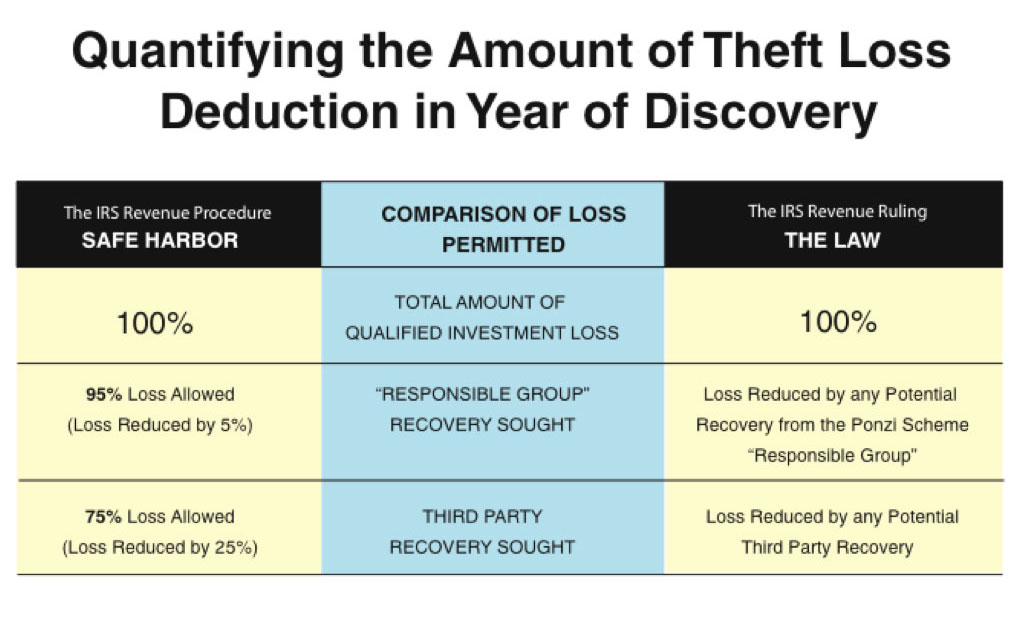

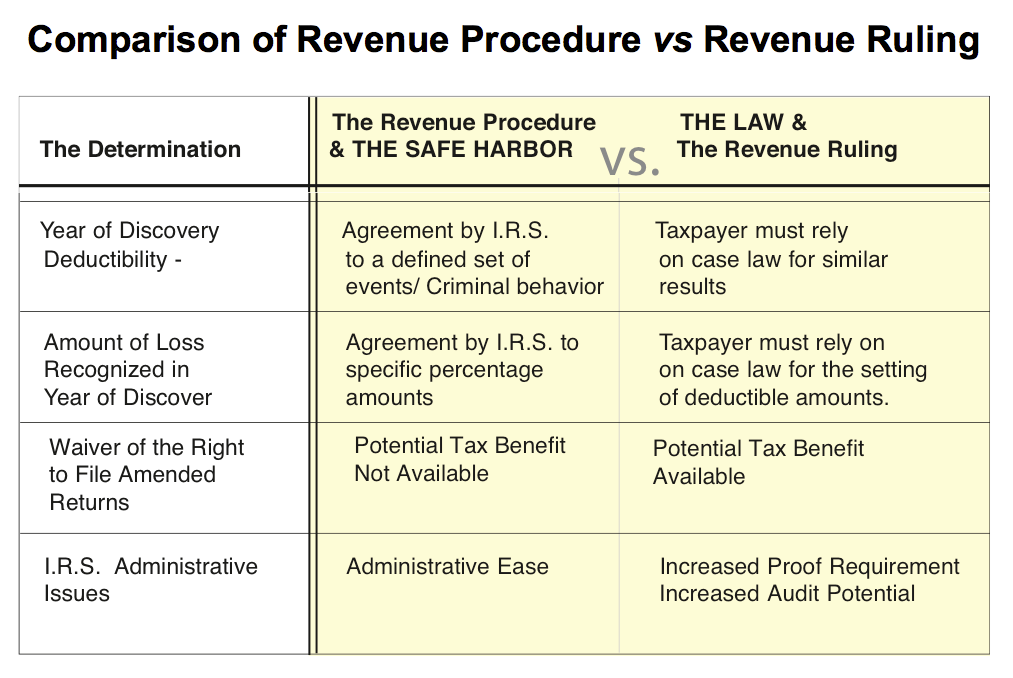

The Ponzi Scheme is a theft loss, and is tax deductible in the year the loss is discovered.

It is important to note, recently (January 24, 2023) the IRS updated questions on common digital assets that include: Convertible virtual currency and cryptocurrency, Stablecoins, and Non-fungible tokens (NFTs). All taxpayers must answer Yes or No to the digital asset question.

Be aware, if you want to get in to the Safe Harbor (The IRS Revenue Procedure) – you have to get started now. 2022 is the “Year of Discovery” for this Ponzi. Don’t be last in line – the IRS is going to be bombarded. A tax attorney can provide valuable legal advice and representation in complex tax matters like this.

References:

- IRS: Updates to question on digital assets; taxpayers should continue to report all digital asset income.

https://www.irs.gov/newsroom/irs-updates-to-question-on-digital-assets-taxpayers-should-continue-to-report-all-digital-asset-income - The FTX Tax Survival Kit: https://www.lehmantaxlaw.com/ftx/

Contact Richard S. Lehman, United States Tax Attorney: