Tag Archives: Fraud

Lessons from Madoff’s Ponzi: 5 Crucial Messages for Investors

Bernie Madoff’s Massive Ponzi Scheme: Bernie Madoff, a prominent figure in the international tax field, orchestrated a fraudulent investment scheme that deceived hundreds, if not thousands, of investors. Madoff’s elaborate scam led people to believe they were earning substantial profits, but in reality, their money was being siphoned off, resulting in devastating losses. The… Read More »

The two most critical mistakes that result in the loss of the maximum advantage of Ponzi tax deductions seem to be:

The failure to deduct tax losses in the correct year and entering into settlements that may result in a reduced value of the loss are the two most significant errors that can lead to the loss of maximum advantage of tax deductions. For instance, if a settlement includes shares of stock that subsequently lose… Read More »

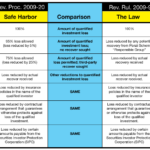

REPORT No. 3: The Safe Harbor

The Revenue Ruling 2009-9 and IRS Safe Harbor (Revenue Procedure 2009-20) In 2009, two important documents were issued by the IRS regarding the taxation of Ponzi schemes. In the Rev. Rul. 2009-9, the IRS clarified much of the previously unsettled law in this area. The Rev. Proc. 2009-20 applies to losses for which the… Read More »