Tag Archives: FTX

The two most critical mistakes that result in the loss of the maximum advantage of Ponzi tax deductions seem to be:

The failure to deduct tax losses in the correct year and entering into settlements that may result in a reduced value of the loss are the two most significant errors that can lead to the loss of maximum advantage of tax deductions. For instance, if a settlement includes shares of stock that subsequently lose… Read More »

REPORT No. 3: The Safe Harbor

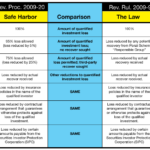

The Revenue Ruling 2009-9 and IRS Safe Harbor (Revenue Procedure 2009-20) In 2009, two important documents were issued by the IRS regarding the taxation of Ponzi schemes. In the Rev. Rul. 2009-9, the IRS clarified much of the previously unsettled law in this area. The Rev. Proc. 2009-20 applies to losses for which the… Read More »