Navigating Ponzi Scheme Losses: Tax Refunds & Clawback Taxation

Richard S. Lehman, J.D./LL.M, United States Tax Attorney

With nearly 55 years as a tax lawyer in Florida, Lehman has built a tax law firm with a national reputation for being able to handle the toughest tax cases, structure the most sophisticated income tax and estate tax plans, and defend clients before the IRS.

- Graduate of Georgetown Law J.D. – Georgetown University

- Masters in Tax Law from New York University Law School

- Law Clerk to the Honorable William M. Fay – U.S. Tax Court in Washington D.C.

- Senior Attorney, Interpretive Division, Chief Counsel’s office, The Internal Revenue Service (IRS)

Mr. Lehman has had extensive experience with all areas of the Internal Revenue code that apply to American taxpayers and non-resident aliens and foreign corporations investing or conducting business in the United States, as well as U.S. citizens and domestic corporations investing abroad. View Full Attorney Profile.

For Those Who Lost Money. . .

Everyone that paid taxes on nonexistent profits will recoup those taxes from the I.R.S. Reports 1-3 below will explain in detail.

Report No. 1: Fraud

The following is Report No. 1 in what is intended to be a series of reports focusing on the tax benefits available as a result of a Ponzi Scheme fraud. Each taxpayer has their own unique factual situation which is going to need to be reviewed by tax advisors and litigation counsel before any legal conclusions can be reached.

Ponzi fraud has resulted in much pain throughout the world. Hopefully some of this can be eased in the form of tax relief from either the U.S. or other countries whose citizens are entitled to permit their financial losses to be deducted from their taxes. REPORT NO. 1: Download 10 page pdf here. or read it online here.

Report No. 2: The Reasonable Prospect Of Recovery

There is no set of fixed rules that clearly define the taxpayer’s reasonable prospect of a recovery, that will result in a limitation of a taxpayer’s theft loss deduction in the year of discovery. However, it is possible to have a grasp of the concept by reviewing court statements defining the concept. We will also look at general principles that have emerged from the court cases and review two cases that could be said to represent the extreme ends of the spectrum of just what is a reasonable prospect of recovery. REPORT NO. 2: Download 10 page pdf or read it online here.

Report No. 3: The Safe Harbor

In 2009, two important documents were issued by the IRS regarding the taxation of Ponzi schemes. In the Rev. Rul. 2009-9, the IRS clarified much of the previously unsettled law in this area. The Rev. Proc. 2009-20 applies to losses for which the discovery year is a taxable year beginning after December 31, 2007; it offers thousands of Ponzi scheme victims a badly needed uncomplicated shortcut to cash refunds from tax losses. These two IRS documents form a good package and were drafted in record time, for any government agency. REPORT NO. 3: Download 8 page pdf here or read it online here.

— I.R.S Documents —

- I.R.S. Revenue Ruling 2009-9: Download the pdf here.

- I.R.S. Revenue Procedure 2009-20: Download the pdf here.

— Ponzi Scheme Information —

- VIDEO: Tax Refunds From Ponzi Scheme Losses: Watch this 50-minute educational presentation. Tax refunds from Ponzi Scheme losses are extremely valuable. https://www.lehmantaxlaw.com/tax-refunds-from-ponzi-scheme-losses/

- PRESENTATION SLIDES: Download as a pdf, 47 slides. Download presentation here.

- ARTICLE: Ponzi Scheme Tax Losses, BNA Tax and Accounting Center, BNA 1-24-11, PDF

This BNA article is from 2011 and does not represent the updated Trump tax plan, yet contains vital important Ponzi material. Download pdf article here.

For Those Who Made Money. . .

If you are in the process of paying back your profits – the law is structured where you can get a tax refund. The amount depends on your tax bracket.

— Clawback Information —

-

VIDEO: Clawback in a Ponzi Scheme – Maximum Tax Recovery, Watch this 50-minute educational presentation: The Ponzi Scheme Clawback. https://www.lehmantaxlaw.com/taxation-of-ponzi-clawbacks/

-

PRESENTATION SLIDES: Download as PDF, 52 slides. Download presentation here.

-

ARTICLE: Favorable Tax Consequences Related to Ponzi Scheme and the Clawback,

BNA 9-19-11, PDF https://www.lehmantaxlaw.com/pdf/BNA_9_2011.pdf.

— Government Accountability Office (GAO) —

- Government Accountability Office (GAO): 80 pager; The Report to Congressional Requesters: Customer Outcomes in the Madoff Liquidation Proceedings. Download the 80 page pdf here.

Other Tax Law Videos:

Listen to Richard Lehman introduce these updated videos on the new Trump Tax plan.

These videos have been updated to reflect the Trump Tax Cut & Jobs Act of 2017:

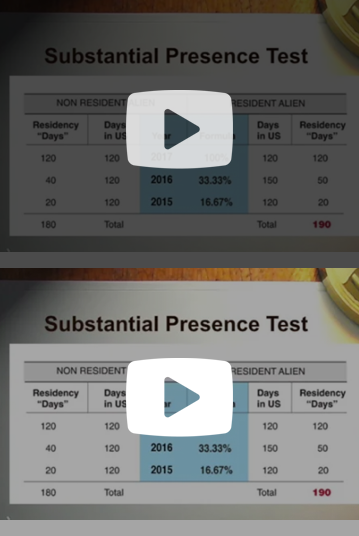

Pre-Immigration Tax Law for Individuals Immigrating to the U.S.

U.S. Tax Video ARCHIVES - Before The 2017 Trump Tax Cut & Jobs Act

Organizations that offer Richard S. Lehman Esq., tax law videos online include…